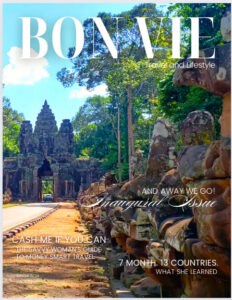

Hey there, fellow jetsetter!

Are you ready to unlock the secret to luxurious vacations without breaking the bank? Here at Bon Vie, we happen to be experts at doing just that.

In this comprehensive guide, we’ll show you how to turn your everyday spending into unforgettable travel experiences.

From understanding credit card points to redeeming them for dream vacations, we’ve got you covered. Bookmark this page, because there’s a ton of gems here to help you build your reward points arsenal. Get ready for the world to become your playground.

Understanding Credit Card Points

Let’s start with the basics: what exactly are credit card points, and why are they valuable?

Credit card points are rewards earned for using your credit card to make purchases. These points can be redeemed for various perks including travel – like flights, hotel stays, and more.

Most programs offer a variety of ways to earn points, with some adding up more quickly than others. Read on to learn the types of programs and how to choose the right card for you.

Types of Credit Card Reward Programs

Credit card rewards programs generally fall into three categories: cash back, points, and miles. Each type has unique features to consider when planning your point strategy.

Here’s a quick overview of each type, and a few example cards that offer each program:

Cash Back Rewards

Overview: You’ll earn a percentage of each purchase back as cash. You can redeem your rewards to a statement credit (to pay down part of your balance, or as cold, hard cash.

These cards are ideal for straightforward rewards without the need to learn complex redemption options, but are among the worst for travel redemption.

Example Cards: Citi Double Cash Card, Chase Freedom Unlimited

Points Rewards

Overview: You’ll earn points for every dollar you spend, that can be redeemed for travel, merchandise, gift cards, and more.

The best programs offer the ability to transfer your points to travel partners, which often their point-to-dollar value.

Example Cards: Chase Sapphire Preferred (Chase Ultimate Rewards), American Express Gold Card (Membership Rewards), Citi ThankYou Premier (Citi ThankYou Points).

Miles Rewards

Overview: You’ll earn airline miles for every dollar you spend, which can be redeemed for tickets, seat upgrades, and other travel-related expenses.

These are best for frequent flyers. Check the program, as airline points are not as flexible as other reward points.

Example Cards: Capital One Venture Rewards Credit Card, Delta SkyMiles Card, American Airlines AAdvantage MileUp Card.

Hotel Rewards

Overview: You’ll earn hotel member points for every dollar you spend, especially when booking rooms at the brand’s hotels.

Points can then be redeemed for free nights, room upgrades, dining, spa services, and other amenities.

Example Cards: Marriott Bonvoy Boundless Credit Card, Hilton Honors American Express Aspire Card.

How to Choose the Right Credit Card

Selecting the right credit card is crucial for maximizing your travel rewards. Though there is a host of options, starting with a travel-centered card is the best option.

Consider the following factors when designing your card portfolio:

Key Considerations

- Annual Fee: While some cards have high annual fees, they often come with valuable perks and benefits that can outweigh the cost.

- Sign Up Bonus: The card sign-up bonus should be high enough to offset most, if not all, of your first year’s annual fee. Research the cards you prefer and submit your app when the sign up bonus is highest.

- Earning Rate: Look for cards that offer bonus points on categories aligned with your spending habits, such as dining, groceries, or travel.

- Redemption Options: Evaluate the flexibility and value of redemption options, including transfer partners and travel portal bookings.

- Value-Added Perks: Cards at this level should offer more benefits than you’ll find on entry-level card offers. Lounge access and statement credits for ancillary travel services like CLEAR are a good start.

- Additional Fees: Things like APR and additional fees are always important considerations when choosing a card. At minimum, your travel cards should charge no foreign transaction fees. What’s the point of a travel card you can’t use while traveling abroad?

Start Your Search: Travel Cards to Consider

| Credit Card |

Annual Fee |

Earning Rate |

Redemption Options |

| Chase Sapphire Reserve |

$550 |

3X points on travel and dining |

Transfer partners, travel portal |

| American Express Platinum |

$695 |

5X points on flights booked directly with airlines |

Transfer partners, Fine Hotels & Resorts |

| Capital One Venture |

$95 |

2X miles on all purchases |

Purchase Eraser, transfer partners |

Reward Programs for Popular Travel Cards

Chase Ultimate Rewards

Known for their flexibility and valuable transfer partners such as United Airlines, Hyatt, and Marriott Bonvoy. Select the Sapphire Preferred or Sapphire Reserve to maximize value.

American Express Membership Rewards

The Membership Rewards program offers a wide range of redemption options including travel, shopping, and gift cards. MR also offers exclusive travel benefits like access to The Hotel Collection and Fine Hotels & Resorts.

Citi ThankYou Points

Versatile points that can be redeemed for travel, merchandise, gift cards, and more, with transfer options to airline partners like JetBlue and Singapore Airlines.

If you’re a frequent traveler who values luxury perks like airport lounge access and elite status, the Chase Sapphire Reserve or the American Express Platinum Card are excellent options due to their premium benefits.

How to Maximize Your Credit Card Points

Now that you’ve chosen the right credit card for you, it’s time to ramp up your points earning potential. Here are some strategies to consider:

Strategies for Maximizing Credit Card Points

Get the Most from Your Sign-Up Bonuses

Capitalize on sign-up bonuses by applying for cards with lucrative offers and meeting the minimum spend requirement within the specified time frame. You’ll usually have 3-6 months to complete the offer.

Most cards have cyclical offers planned each year. Track your favorite cards and apply when the sign-up bonus is highest, and offers you the best value.

Use Credit and Pay In Full

Instead of using a debit card, use your credit card to pay for all your daily purchases and pay it off in full every month. This strategy will build up your points bank quickly, without risking debt from unnecessary purchases.

Your credit cards are also safer to use, since they offer purchase and fraud protection. If something goes wrong, you’re protected from undue financial burden.

Take Advantage of Bonus Categories

Take advantage of bonus categories to earn extra points on everyday purchases. These bonus promotions can be worth 2-3 times as many points for the featured categories.

For example: Let’s say a card offers 5x bonus points per dollar spent on restaurant purchases. A $100 dinner is worth 500 points toward your next getaway instead of 100. Those points add up.

Grab Your Referral Bonuses

Refer friends and family to your credit card to earn additional points. It’s a win-win for you and the person to whom you recommend the card. You’ll get a referral bonus, and the card issuer will bump up their sign-up bonus as well.

Of course, you can only refer people to the cards you carry. A 15-20,000 point bonus is a nice perk for recommending cards you believe in.

How to Use Your Credit Card Points for Luxury Vacations

Redeeming your hard-won points for luxurious vacations takes a little planning and strategy, but it’s worth it. Using credit card points can is an easy way to experience dream destinations without breaking the bank.

Here’s how to do it:

Research Your Destination: Research your desired destinations to uncover reward deals first, then choose your must-see attractions.

There are tons of travel blogs, forums, and guidebooks that offer “travel hacking” insider tips and recommendations. You’ll be amazed by the amount of research savvy travelers do to get more back for their buck (or point, in this case).

Plan Your Point Strategy: Create your itinerary with your points in mind. Choose the flights, accommodations, and experiences your points will cover, and plan those out first. Make those bookings, then handle the rest with your preferred credit card.

Make a Smart Travel Budget: Set a realistic budget for your trip, taking into account additional expenses airport transfers, accommodations booked without points, dining, and activities.

If you need support tracking everything, use a travel budgeting tool to keep things straight.

Travel During Off or Shoulder Season: Make your points go further by traveling “off season.” By choosing to travel during the slower months, you’ll enjoy less crowding at popular sights and more flight and hotel availability.

Since business is slower, you can snap up amazing deals on dream vacations – even when paying with points. Keep an eye out for redemption promos.

How to Redeem Credit Card Points to Pay for Your Vacation

Once you’ve earned a ton of points and chosen your destination, it’s time to redeem your rewards points to book your travel. Though each program has its own rules about how to redeem points, there are two main ways to turn your rewards into days at the beach.

You’ll either transfer your reward points from your credit card’s point bank to a travel partner, or book your vacation through the card’s travel portal. Each option has different uses, and you need to consider both to maximize your point value.

Transfer Points to Your Credit Card’s Travel Partners

Maximize the value of your points by transferring them to travel partners like airlines and hotels. This will often result in better redemption rates and access to exclusive benefits.

Most hotel groups occasionally offer bonus points when you transfer points in from their preferred credit cards. Bonuses regularly go as high as 40-50%. Check your program before booking any hotel.

Example:

Let’s say you’ve accumulated a substantial number of Chase Ultimate Rewards points. You can transfer them to Marriott to book a luxury hotel stay at the Prince Gallery Tokyo Kioicho, where you’ll enjoy breathtaking views of the city skyline and impeccable service.

The best part? Marriott regularly runs transfer bonuses of 30-40% through the Ultimate Rewards programs. You’ll get to experience Tokyo for an even better value.

Book Through Your Credit Card’s Travel Portal

Alternatively, you can use your points to book flights, hotels, and activities directly through your credit card’s travel portal. While this usually offers less value than transferring points, it can provide greater flexibility and convenience.

Occasionally, you’ll find great deals booking through your credit card’s portal. When using American Express platinum, for example, there are some deals you can only access through their booking engine.

Ready to use your annual Fine Hotels & Resorts credit, for example? Those deals are exclusive to the brand.

Tips for Enjoying Your Points Paid Luxury Vacation

You’ve done the work and created an amazing vacation with your credit card points. Congrats sis, you deserve it! Here are some tips to enhance your travel experience:

Maximize Your Perks

Take advantage of complimentary perks offered by your credit card, like airport lounge access, hotel upgrades, and travel insurance. All the best travel cards offer access to at least one lounge network when traveling to major destinations. Put yours to good use.

Enjoy Immersive Experiences

Seek out unique experiences that allow you to immerse yourself in the local culture and traditions. Whether it’s a cooking class, cultural tour, or volunteer opportunity, these experiences can enhance your travel memories. Check your card for special offers in your preferred destinations.

Start Earning Toward Your Next Getaway

Choose your primary travel card wisely, and use it for most purchases while you’re on vacay. By using a travel-focused card, particularly one that offers bonuses on travel purchases, you can rack up thousands of points toward your next vacation before you return home.

Imagine you plan a girls’ trip to Miami. By using a credit card that offers bonus points on travel and dining, you can earn extra points when booking flights, hotels, and dining at the best restaurants in the city. You’ll be racking up points for your next vacation while on vacation. Finesse.

Point Redemption Success Stories

Still not convinced that credit card points can unlock luxurious travel experiences? Let the inspiring success stories of those who’ve already done it be your guide. From solo adventures to family getaways, women are using credit card points to create unforgettable memories around the globe.

At the time of this writing, I was looking out over the Panama Bay from a 4.5 star hotel that I booked for two weeks using about $500 worth of credit card points.

If I can do it, so can you.

The Wrap Up

Congratulations, girl! You’re now armed with the knowledge and strategies to create your own luxury vacations using credit card points.

By using your credit cards as a tool, you can turn your travel dreams into reality and create memories that will last a lifetime. The world is waiting – are you ready to explore? Start earning points and chart your course to adventure. Safe travels!

Frequently Asked Questions

Q: Are credit card points worth it?

Absolutely! When used strategically, credit card points provide tremendous value and can enable you to travel in style without breaking the bank.

Q: Can I earn credit card points without going into debt?

Yes! By using your credit card instead of a debit card, and paying your balance in full each month, you can earn points without accruing debt. You’ll be using your card to pay for things you already buy – and earning points in the process.

Q: How do I know which credit card is right for me?

When choosing a credit card, think about your travel goals, spending habits, and lifestyle. Look for a card that aligns with your priorities and offers benefits that will enhance your travel experience.

This “On the Money” article first appeared in the Spring 2024 issue of Bon Vie magazine. Subscribe to BonVie+ for more exclusive content.

Leave a Reply

Want to join the discussion?Feel free to contribute!